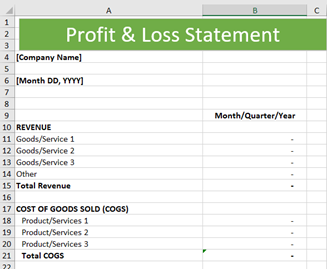

In columns B & C, you will list each of your legal entities.In column A, you will get an overview of all your Profit and Loss accounts.This tab consolidates your Profit and Loss numbers from all of your various entities. What's inside the Consolidated P&L Template? 1 - The Dashboard Tab If you would like to receive personal 1:1 help from our team, then book a call completely free of charge. The video takes ~ 10 minutes, and investing these 10 minutes will save you hours of work down the line. We HIGHLY recommend watching our step-by-step video guide above that explains all of the steps needed to create your consolidated P&L dashboard. Your formulas will now automatically be connected, but make sure to drag them down if they're not covering all the cells you're looking to cover.Replace the values in cells B10 and B11 with the names of each of your P&L sheet tabs.Now, copy/paste your Profit and Loss Accounts (chart of accounts) from your parent company into the Dashboard tab.Import a Profit & Loss report using the date range "This Year" from all of the respective entities that you want to consolidate.If you are already a LiveFlow user, go to "Extensions" -> "LiveFlow." If you're not a user yet, then install LiveFlow first. Connect your Google Sheet to LiveFlow so that you can connect live Profit and Loss reports.Click on "File" -> "Make a copy" - This will create a copy for your own Google Drive.If the numbers do not fit your forecast, review your expenses to decrease them or look for new revenue streams to increase profits. How To Use This Consolidated P&L Template? The same goes for comparing your forecast with reality after the first month. If you don't like what you see, your business plan and strategy require more work. Use your business plan to generate a predictive P&L report, adding the expected revenue and expenses to calculate the net earnings. If your net earnings are increasing over a few months, your chances of getting funded are good.Īnother way to use the profit and loss statement is for planning and forecasting.

It can help to secure funding for your small business from investors or to get a bank loan. Startup P&L statement is not for your eyes only. If the number is in the negative, your expenses exceed the revenue, and without quick intervention, you can go broke soon. Using this one line, you can evaluate how good or bad the business is faring. The final line of the statement returns net earnings or losses after interest and taxes.

P&L report shows your business profitability over a period of time (month, quarter, year).

Among the variety of accounting files, profit and loss statement is often overlooked despite its vital role.

0 kommentar(er)

0 kommentar(er)